Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

Life Insurance is not about investing your money to earn a return on it, it’s about financial protection for your loved ones. And the most efficient way to do that is through a term insurance policy.

This policy does not invest your money which means you pay only for insurance and after the policy term ends you don’t get any money back. But on death during the policy term, it pays a huge corpus to the nominees that can help them tide over any financial crunch and ensure their live are not thrown out of whack. A term plan is the only kind of life policy you need to have because it gives you a large cover for low cost. Read here to know more about term plans.

However keep in mind that buying a term plan also needs due diligence at your end when filling up the insurance policy form called as the proposal form. Read here to understand what determines your experience of buying a term insurance policy:

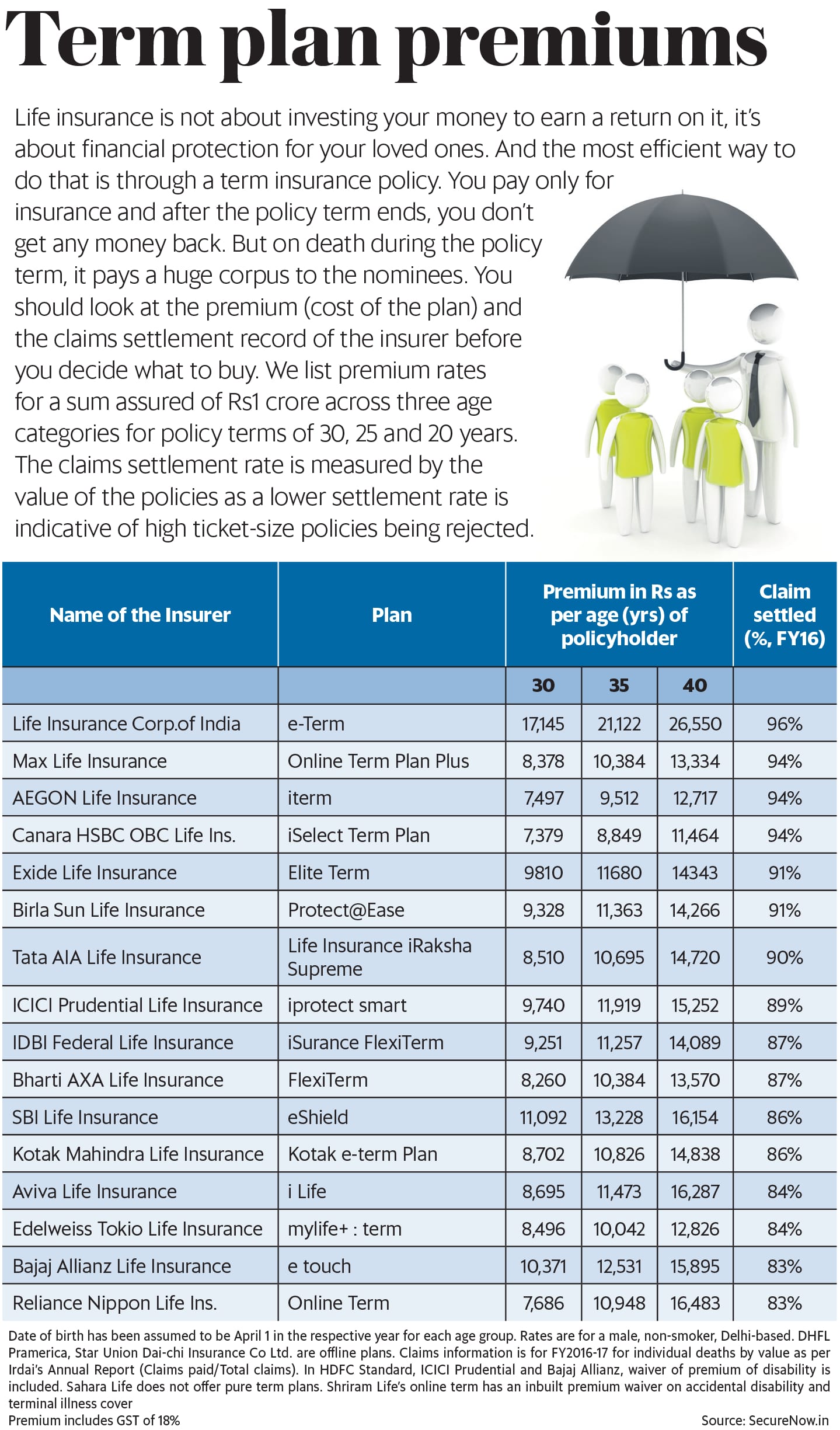

Further, there are many types of term plan to choose from and you can read this piece to understand the universe of term plans. You should look at the premium (cost of the term plan) and the claims settlement record of the insurer before you decide what to buy. To help you do just here the premium rates for a sum assured of Rs1 crore across three age categories for a pure term insurance policy. Policy terms are 30, 25 and 20 years, respectively. The claims settlement rate is measured by value of the policies as a lower settlement rate is indicative of high ticket size policies being rejected.

319, RG MALL Sector-9, Rohini,

Near Rohini West Metro Station,

New Delhi-110085, India

+91 9811083803

+91 9717566266

rajiv@richinsurance.in

richcare@richinsurance.in

Copyright © 2026 Design and developed by Fintso. All Rights Reserved