Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

|

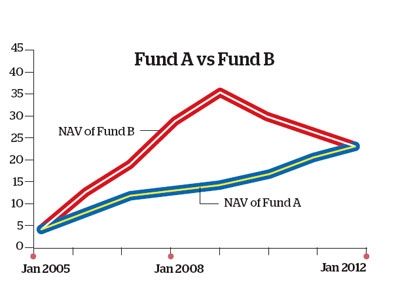

One of the simplest ways is to look at the historical analysis of returns. For this, one can either consider point-to-point returns or rolling returns. Let’s look at what these terms mean, and which one is a better measuring tool. Point to point returns: These returns are calculated by considering the NAVs at two points in time-entry date and exit date. Suppose you invested in the growth option of a mutual fund scheme in January 2005 at a NAV of 12. Now, if the NAV were to rise to 32 on the exit day, say, January 2012, using point-to-point returns you’ll find that your fund has generated an absolute return of 166.67%. |

| If the defined interval is three years, the point-to-point returns will be calculated from 1 January 2005 to 1 January 2008, and so on, till the end of the holding period. The average of all the figures will help arrive at the three-year rolling return. Hence, calculating rolling returns is a better way to ferret out consistent performers. |  |

319, RG MALL Sector-9, Rohini,

Near Rohini West Metro Station,

New Delhi-110085, India

+91 9811083803

+91 9717566266

rajiv@richinsurance.in

richcare@richinsurance.in

Copyright © 2026 Design and developed by Fintso. All Rights Reserved